Will Nigeria’s 2026 Tax Reforms Affect Remittances? Here’s What You Need to Know

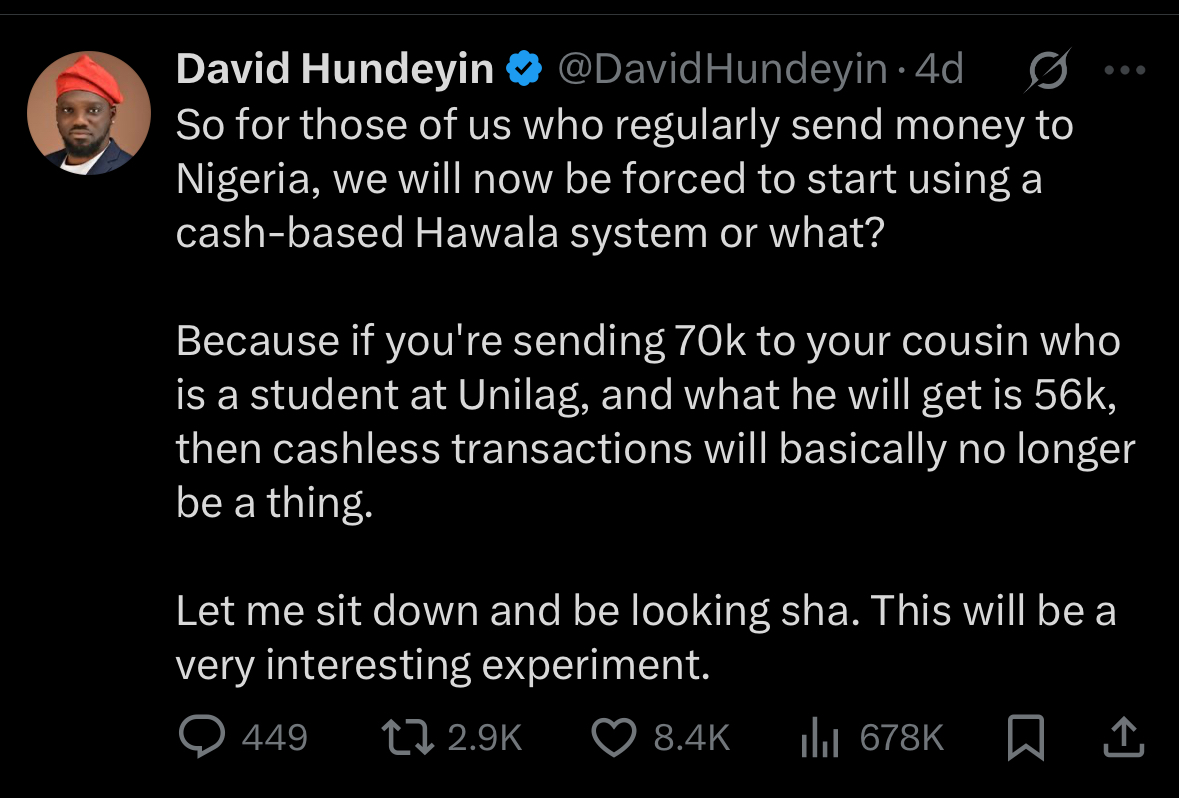

On X (formerly Twitter), investigative journalist David Hundeyin recently voiced a concern that has quickly rippled through diaspora communities.

The post, shared thousands of times, struck a nerve. Nigerians abroad collectively send home over $20 billion every year, making remittances one of the country’s biggest sources of foreign exchange. Any hint that this money will be taxed, eroded, or trapped sparks immediate fear.

So, is Hundeyin right? Will Nigeria’s 2026 tax reforms slash remittances by 20%?

The short answer: No. But there are important changes you should understand.

What’s actually changing?

On January 1, 2026, Nigeria will implement a sweeping overhaul of its tax system. The Nigeria Tax Act, 2025, along with companion laws, consolidates decades of fragmented legislation into one framework.

Key highlights:

- A new Nigeria Revenue Service (NRS): replacing FIRS, with broader powers to collect both tax and non-tax revenue.

- Fairer rules for individuals: millions of low-income Nigerians will be exempt from personal income tax.

- Corporate tax relief: micro and small businesses (turnover under ₦100m) will no longer pay corporate income tax.

- VAT exemptions: essentials like food, healthcare, transport, education, and accommodation are now VAT-free. That means every naira your family receives buys a little more.

- Stricter compliance: banks and licensed money transfer operators must improve reporting, transparency, and record-keeping. If you own a business abroad but run it from Nigeria, it could be classified as a “Nigerian company” under effective management rules. This mostly hits entrepreneurs and investors, not workers sending money home.

What’s not changing: Remittances aren’t taxed

Despite the panic online, there is no clause in the reforms that introduces a “remittance tax.”

- If you send $47 (about ₦70,000) to a cousin at Unilag, they will still receive the full amount, minus only the usual transfer fees and the ₦50 Electronic Money Transfer Levy that has been in place since 2020 for domestic transfers above ₦10,000.

- There is no 20% rule forcing Nigerians abroad into cash-based systems.

Hundeyin’s hypothetical — ₦70k reducing to ₦56k — does not appear in any provision of the law.

Where the confusion comes from

So why are people bracing for the worst? Three main reasons:

- Worldwide income rules: Nigerian residents will now be taxed on their global income — salaries, dividends, and business profits earned abroad. This is a major change for Nigerians with overseas earnings, but it does not affect diaspora Nigerians sending family support back home. If your foreign income was already taxed abroad and sent through official channels, you may qualify for relief.

- Stricter compliance requirements: Banks and money transfer operators will face more paperwork and reporting rules. To customers, this may feel like new barriers or costs, even though the underlying remittance remains untaxed.

- A history of sudden levies: Nigerians have seen new charges pop up overnight — from stamp duties to the ₦50 transfer fee. Understandably, a sweeping tax reform sparks suspicion that remittances could be next.

What this means for you

For now, the picture is clear:

- If you send money to family in Nigeria, nothing changes. Your remittances are not taxed.

- If you are a Nigerian resident earning abroad, your global income may now be taxable in Nigeria, so consult a tax professional to understand your obligations.

- If you use informal channels, the risks are higher than ever. With stricter compliance in place, cash-based or underground systems could face disruption, leaving families vulnerable.

Why official channels matter more than ever

The new rules are designed to push transactions into transparent, regulated systems. For senders abroad, that means one thing: stick to trusted, licensed platforms.

AfriChange, for example, is built to keep diaspora transfers fast, safe, and compliant with both Nigerian and international regulations. By using official channels, you don’t just protect your money; you also ensure your family receives the full value without unnecessary risk.

The bottom line

David Hundeyin’s viral tweet captured the deep distrust Nigerians feel toward government policies, but the facts show a different story. Remittances are safe.

Nigeria isn’t coming after diaspora remittances. In fact, the reforms may make those dollars more impactful by exempting essentials from VAT. For the diaspora, the real shift is about clarity: knowing your tax status, understanding how your money is classified, and making sure you use compliant, transparent channels.

Your remittances remain a powerful force, and under the 2026 reforms, they may go even further.

AfriChange is a cross-border remittance platform that makes it easy for Nigerians in the diaspora to send money home quickly, safely, and at the best rates. Through its growing network of corridors, including Australia to Nigeria, Canada to Nigeria, the UK to Nigeria, and the US to Nigeria. AfriChange helps users move funds directly into local bank accounts or mobile wallets within minutes. By combining compliance with convenience, AfriChange ensures that every transfer not only arrives securely but also delivers maximum value to the families and businesses who depend on them.