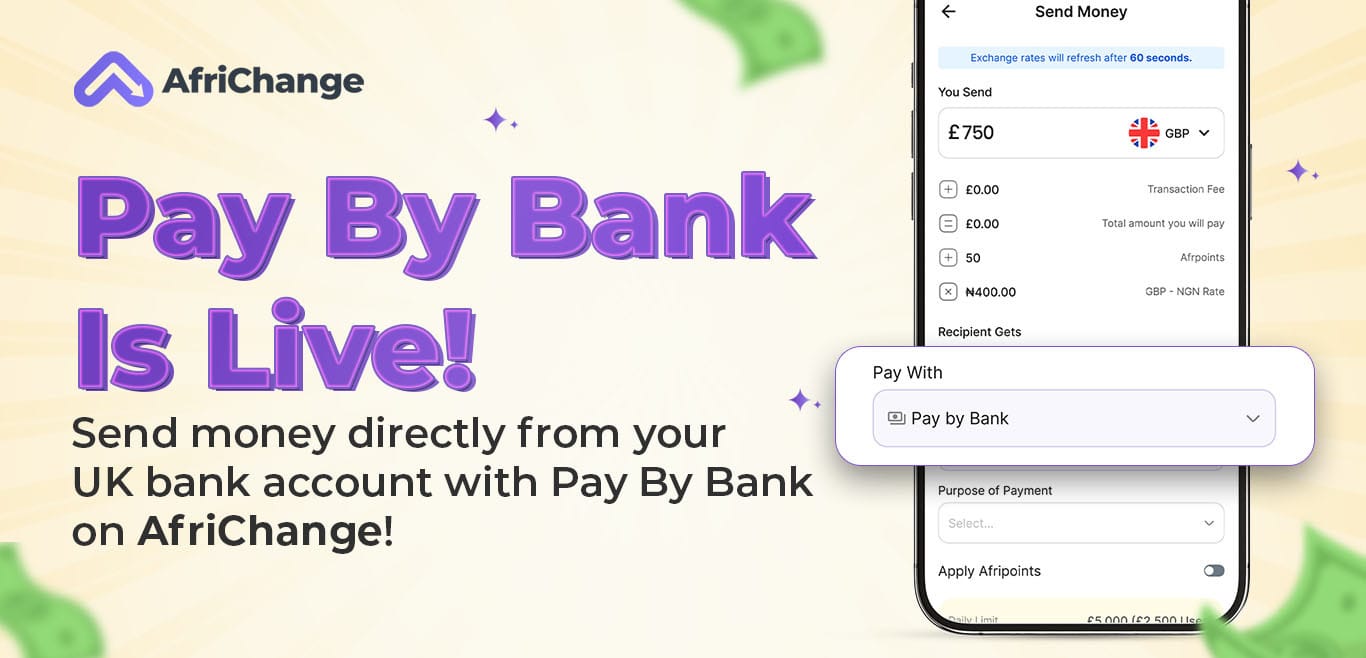

Pay by Bank on AfriChange: An Easier Way to Send Money from the UK.

Sending money abroad shouldn't feel like a task. And, that’s why we’re excited to introduce a new way to fund your transfers: Pay by Bank on AfriChange!

This isn’t a replacement for our existing payment methods. It’s an additional option, built to make things simpler for our UK users. If you’ve used our regular bank transfer method before, you already know the process: initiate a transaction, receive a virtual account number, and then complete the payment through your bank app.

It works and it’s still available. But now, there’s another way.

Read also: What Is an IBAN and Why It Matters When Sending Money Abroad.

What is Pay by Bank?

Pay by Bank is a digital payment method that allows you to connect your UK bank account and approve payments directly from your banking app or online platform.

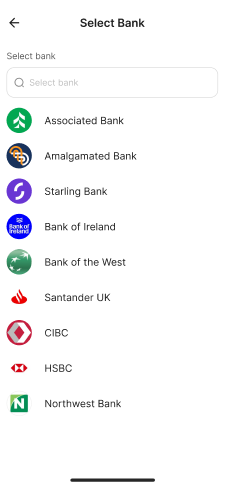

Here’s how it works on AfriChange: once you select Pay by Bank, you choose your bank, get redirected to your banking platform, approve the payment, and that’s it. Everything starts from AfriChange, but authorisation happens on your bank’s side, ensuring a smooth, familiar experience on both ends for you.

Every payment is authorised individually, and you’re always in control.

Why Is Pay By Bank Needed and Important?

We built this feature to make sending money from the UK effortless. Pay by Bank is designed for speed and simplicity, offering a payment experience that is:

- Fast from start to finish: Payments via 'Pay by Bank' are processed once you hit approve on your bank app, your money is sent immediately to the beneficiary, wherever they are.

- No switching apps or copying details: The entire process from choosing your bank to confirming payment, happens in one uninterrupted flow, making things easier for you.

- Smooth and secure: Every transaction is authorised by you within your own bank app. Nothing is stored, nothing is shared, and your authorisation on every transfer is key.

If you’re wondering whether people are actually using the Pay By Bank (Open Banking) feature around the world, yes, they are:

- The number of global Open Banking users around the world was reported to be 132 million, and this number will grow rapidly over the years.

- 87% of users say they prefer it over traditional methods.

- It’s not a fintech buzzword. It’s the new normal.

How to Use Pay by Bank On AfriChange (Via Web or App).

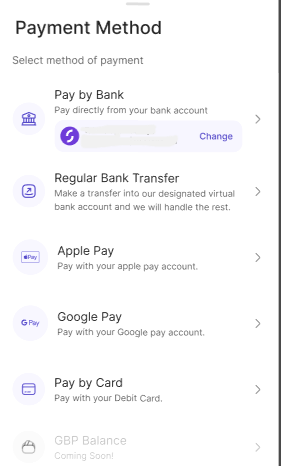

For existing users in the UK: Whether you're using a phone, laptop, or tablet, Pay by Bank works the same way:

- Start by logging in to your mobile app or click here to login via web.

- Select Pay by Bank when you want to initiate a transaction.

- Choose your UK bank.

- Authorise the payment in your banking app or website.

- Transaction is initiated after authorisation.

For new users in the UK:

- Create an account and complete your KYC.

- Make your first international money transfer to any country of choice to verify your account.

- After verification, Pay by Bank will be available.

New users will start with a £500 limit, and move to £3,000 after completing three successful Pay by Bank transactions.

Read also: How to Send Money from Nigeria to the UK — Naira to Pounds.

Pay by Bank vs Regular Bank Transfer

Our regular bank transfer method isn’t going anywhere, it’s a reliable option that continues to serve many users. But if you're looking for a quicker option, Pay by Bank is worth a try.

Instead of switching apps or manually entering account numbers, you start and end within a controlled, connected flow. It's ideal if you want fewer steps without compromising security.

Wrapping Up...

Pay by Bank doesn’t replace our other AfriChange payment options, it complements them. So if you love using cards or push transfers, keep using what works for you. But if you want to a try something faster, Pay by Bank is ready when you are.

Ready to try it? Update your AfriChange mobile app or AfriChange web page, link your UK bank account, and give Pay by Bank a go today!